Business owners and executives of litigation support services companies understand how important good cash flow is to run their business. In addition to normal operating expenses, litigation support services companies carry the unique burden of advancing hundreds of thousands, even millions of dollars, for court fees each year on behalf of their customers. If not collected in a timely fashion, these advances will quickly cripple cash flow.

Prior to founding LegalConnect in 2016, CEO David Nill, experienced these same challenges as the owner of an attorney service company, Rapid Legal.

“One of the biggest obstacles for any business is to maintain a healthy cash flow. But litigation support services firms experience a bigger cash flow challenge than your typical business because of the extraordinary volume of fees they pay out to courts for their clients. As an example, you could have an attorney service firm that generates $6 million of revenue in a year, but they advanced $20 million of court fees in that same period. Consequently, overdue accounts receivables are a big source of anxiety because these companies are not only collecting their service fee, but also the hundreds of dollars of court fees per transaction,” said David.

So how did David get customers to pay on time? He focused on three key areas for effective management of accounts receivable: Communication, Process, and Technology. In this article, we will explore how spending some time re-evaluating each of these areas in your organization can significantly improve your cash flow position.

Communication is Key

Pricing transparency and consistency are important. Traditionally, billing in the legal industry is characterized by confusing, obscure pricing and invoicing practices, leading to customer avoidance, confusion, and additional auditing, resulting in slow pay. Ensure that your pricing sheets are easy to understand, and invoices are clearly labeled to avoid some of these pitfalls. For example, according to Intuit, a good invoice should have these components:

- Company Information

- Header

- Date, Invoice number and unique identifier

- List of Goods and Services

- Name of the good or service provided

- Date the good or service was provided

- Rate for the good or service provided

- Quantity of the good or service provided

- Terms of Payment

- Itemized Fees

- Total Amount Due

Take the time to communicate and educate your customers on what you are charging for and explain at what point(s) in time do you charge. Be sure to thoroughly describe what timelines, service level agreements/priority levels, and geographies (i.e., areas of service) are and how this impacts the price.

If you are leveraging technology for invoicing, be sure that the solution allows you the flexibility to customize your prices and that the outputs it produces (i.e., invoices, notifications, email reminders, etc.) all effectively communicate the pricing and terms clearly to customers.

Ultimately, communication with your customer is key because it is important that you collect your fees quickly so that you have enough cash in the bank to advance tomorrow’s court fees, and the day after that, and so on.

Re-examine Your Invoicing Policies and Processes

Equally important, if not more important, is ensuring that different teams across your organization and your customer’s organization also understand the invoicing process, from Sales to Operations to Accounts Receivable. Keep your process clear and straightforward. Be sure that each associate understands the invoicing process and can explain it well. This is important so that at every touchpoint, there is the opportunity to address and prevent issues proactively.

Within the teams, create and improve policies that everyone agrees upon and is required to follow. Some examples include:

- Establish a firm credit-granting policy.

- When an account becomes overdue, take action immediately.

- Develop a system or process of collecting accounts.

- Send invoices promptly and consistently.

Improve communication among teams by conducting regular touch-base meetings to discuss issues actively. Whenever possible, leverage technology to improve your processes. Software has made it easier to streamline operations and send automatic notifications when an action is completed so that everyone is kept in the loop.

Technology Saves the Day

Accounts Receivable software integrated with litigation support service platforms can significantly help streamline invoicing processes and improve the collections effort. As a result, law firms have been able to move away from the expected legal industry norm of “perform the work now, bill later.” With recent advances in technology, litigation support services have evolved into a transactional, daily billing model.

There are many advantages to daily or “very frequent” billing. They include:

- It drastically reduces the customer’s time and resources required to reconcile

- The sooner you bill, the better, as the invoice stays top of mind with the customer. You’ll encounter fewer problems earlier on, as the older the invoice, the likelihood increases that there will be pushback, rejection, and other delays.

- Most importantly, you’ll always have regular cash flow as there are no delays between the time service is provided and when a bill is received by the customer.

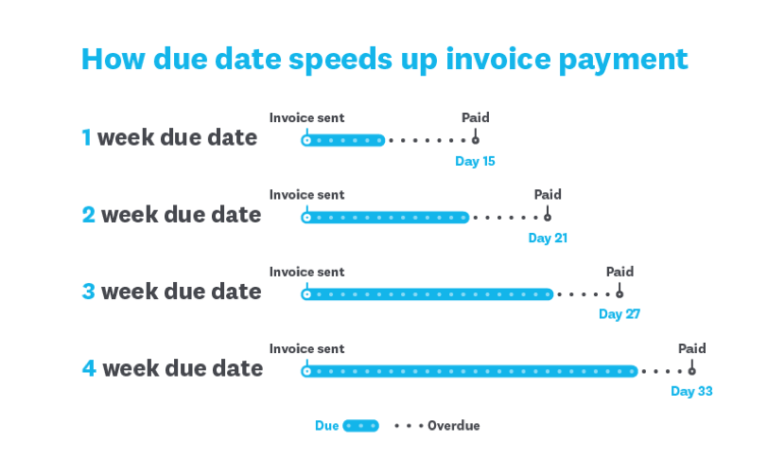

With technology, long payment terms are a throwback to the days of snail mail and payment by check. Now that most businesses send invoices electronically and payment is made online, invoice payment terms (i.e., “net-30”) are obsolete and a thing of the past. Negotiate with your customers to agree upon shorter invoice payment terms whenever possible, perhaps offering early-payment discounts as an incentive.

This diagram below shows how shorter payment terms helps you get paid faster, improving your cash flow situation:

When transitioning your customers to shorter invoice terms, you may get pushback, with reasons such as wanting to save cash, or ‘we always did it that way,’ or ‘we want to review our statement’. The fact is, a lot of businesses may turn to their account receivable as a way to receive a small “loan”. Your customers may try to negotiate terms with you, but it should only be used as a last resort, as once you’ve committed to that, you’re essentially giving away a portion of your cash flow.

You can overcome some of these hurdles by effective communication and having processes and technology in place that help support and automate those processes. Explain and show your customer that with daily billing, it is more accurate, and it results in fewer disputes, thereby also freeing up their time and resources in having to reconcile the invoices.

The Bottom Line

“Revenue is vanity. Profit is sanity. Cash is king.”

– Alan Miltz, global thought leader in financial analysis

Effective accounts receivable management is key to healthy cash flow. Improving your organization’s collections process with smart tools will help you minimize the risk of late payments, even in today’s unpredictable market. If you don’t currently have a centralized system and a unified collections workflow, now is the time to establish one. Ideally, this system is managed and accessible across multiple teams – sales, accounts receivable, and collections – no matter where they are working from these days. As mentioned above, keep your process simple, and ensure you communicate it clearly to both your teams and to your customers.

In summary,

- Invoice early and often

- Reduce invoice disputes by being proactive, transparent, and consistent with your communications

- Use automation whenever possible by leveraging technology

Cash flow is the lifeblood of every small business. Ensuring that your organization has healthy cash flow is essential for optimal growth and business continuity, even in an economic downturn or global crisis.