In 2016, Justin Kaul, Director of Operations at Swift Attorney Service, set out to modernize the operations of the 40-year-old company. Founded by his father, Frank Kaul, in 1976, the company was successful and grew steadily over the years, but Justin understood the need to innovate its business operations in order to remain competitive for the next 40 years and beyond.

Challenge: Manual Processes Stunt Efficiency and Cash Flow

At the time, Swift was using a collection of tools to manage and conduct its business, including a generic order and document management system, various Excel spreadsheets, homegrown databases and ad hoc processes. These out-of-date and disparate tools required heavily manual processes resulting in redundant data entry by staff that was time-consuming and error-prone.

Cash flow was another challenge for Swift. Accounts receivables were delayed because accounting staff had to manually and tediously invoice customers at the end of each month which was not only time-consuming, but also tied up valuable revenue. Subsequently, Justin turned to LegalConnect for the company’s deep expertise in the litigation support service industry, including how to transform business workflows using its innovative, proprietary technology.

Solution: Litigation Support Service Technology Aids Firm’s Financial Position

Using LegalConnect’s litigation support service software, Swift was able to modernize its business operations by digitizing and automating its manual processes as well as eliminating the company’s disparate operational toolset.

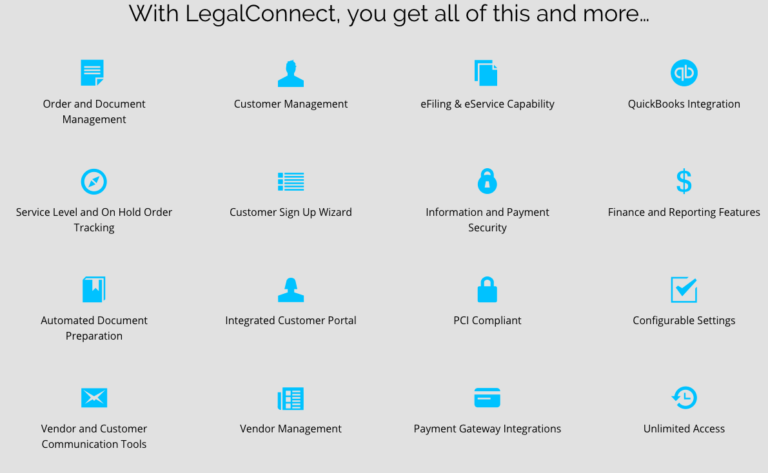

“LegalConnect had all of the requirements and features we needed to upgrade our operations including information and payment security, finance and reporting capabilities, payment gateway and accounting integrations, plus a robust network of court eFiling integrations. It streamlined account and order creation for our customers, as well as automated our back-end operational and accounting functions. This was critical for transforming our business and setting it up for success for many more decades to come,” said Justin.

LegalConnect’s Customer Portal enabled Swift’s customers to create accounts and place orders for litigation support services including eFiling, physical court filing, process serving and more, anytime, anywhere. Moreover, with LegalConnect, customers provide payment information and pay at the time they place an order. Since LegalConnect is integrated with Quickbooks Online, all order and payment data are automatically, and securely stored in the accounting software for quick, easy access. LegalConnect’s Operations Portal features a finance management dashboard that centralizes order data, advance check information for vendors, payment disbursements, and finance reports. “All of these features empowered our company to manage billing securely and efficiently from start to finish,” said Justin. “Plus, LegalConnect’s autopay and direct deposit features helped alleviate our cash-flow challenges, which was a big advantage for us.”

Swift’s customers were able to pay directly in the LegalConnect customer portal eliminating the need to generate statements and go through the tedious, time-consuming process of invoicing customers each month. According to Justin, “Transactions were now automated and error-free. As a result, it freed up valuable time and resources for my employees so they could focus on more impactful projects and initiatives. Additionally, cash-flow was no longer a nagging concern for us.”

Results: Technology Unleashes Attorney Service Business Growth

By streamlining operational and financial business processes, Swift Attorney Service was able to maximize business efficiency and improve staff productivity. The company also dramatically reduced its outstanding accounts receivable balances and aging AR balances from months to days, as a result of LegalConnect’s ability to process credit card and ACH payments from customers. Furthermore, leveraging LegalConnect’s operational and financial reporting, including orders by customers, orders by job types and advancement of court fees, Swift’s Management was able to gain greater visibility into its business thereby improving decision-making.

Swift is also seeing long-standing customer relationships strengthened through LegalConnect. LegalConnect delivers a consistent, easy-to-use experience at each touchpoint, from ordering to fulfillment to billing. LegalConnect has been well-received by Swift customers and has been instrumental in generating new customers.

“With LegalConnect, we have seen a dramatic impact on the financial health of our business, reducing 60% of our outstanding AR from months to days and accelerating cash into the business. Overall, our business is in a stronger financial position today than before we implemented LegalConnect.”

– Justin Kaul, Director of Operations, Swift Attorney Service

About Swift Attorney Service

Swift Attorney Service is a fully licensed and bonded process serving and private investigation company. Based in Redwood City, California, Swift has been a pillar in the San Francisco Bay Area legal service industry for over 40 years. With over one million serves completed since opening in 1976, Swift Attorney Service is dedicated to excellence in customer service and maintaining a standard of professionalism that is unmatched in this field. After nearly half a century in business, you can rest assured that your legal order processing is in good hands, whether here in California or Nationwide. Learn more at www.swiftlegal.com.

About LegalConnect

LegalConnect is a premium legal technology company that automates the processing of legal documents for law firms. Headquartered in Chino Hills, California, the company is a leading certified eFiling Service Provider to courts in 36 California counties, with more on the way, and has more than 16,000 legal professionals and 14,000 law firms using its platform. Combining deep industry expertise, innovative technology, and a robust channel partner network, LegalConnect is transforming the way the legal community exchanges electronic documents, information, and payments, to streamline how law firms manage work, and for the effective and expeditious administration of justice. Learn more at https://legalconnect.com/.